Renters Insurance in and around Houston

Houston renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Houston

- Sugarland

- Missouri City

- Cypress

- Katy

- Harris County

- Fort Bend County

- Galveston County

- Montgomery County

Insure What You Own While You Lease A Home

There's a lot to think about when it comes to renting a home - internet access, price, utilities, house or townhome? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Houston renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Why Renters In Houston Choose State Farm

When the unanticipated burglary happens to your rented property or condo, generally it affects your personal belongings, such as sports equipment, a tablet or a bicycle. That's where your renters insurance comes in. State Farm agent Felicia Olowu is passionate about helping you examine your needs so that you can protect your belongings.

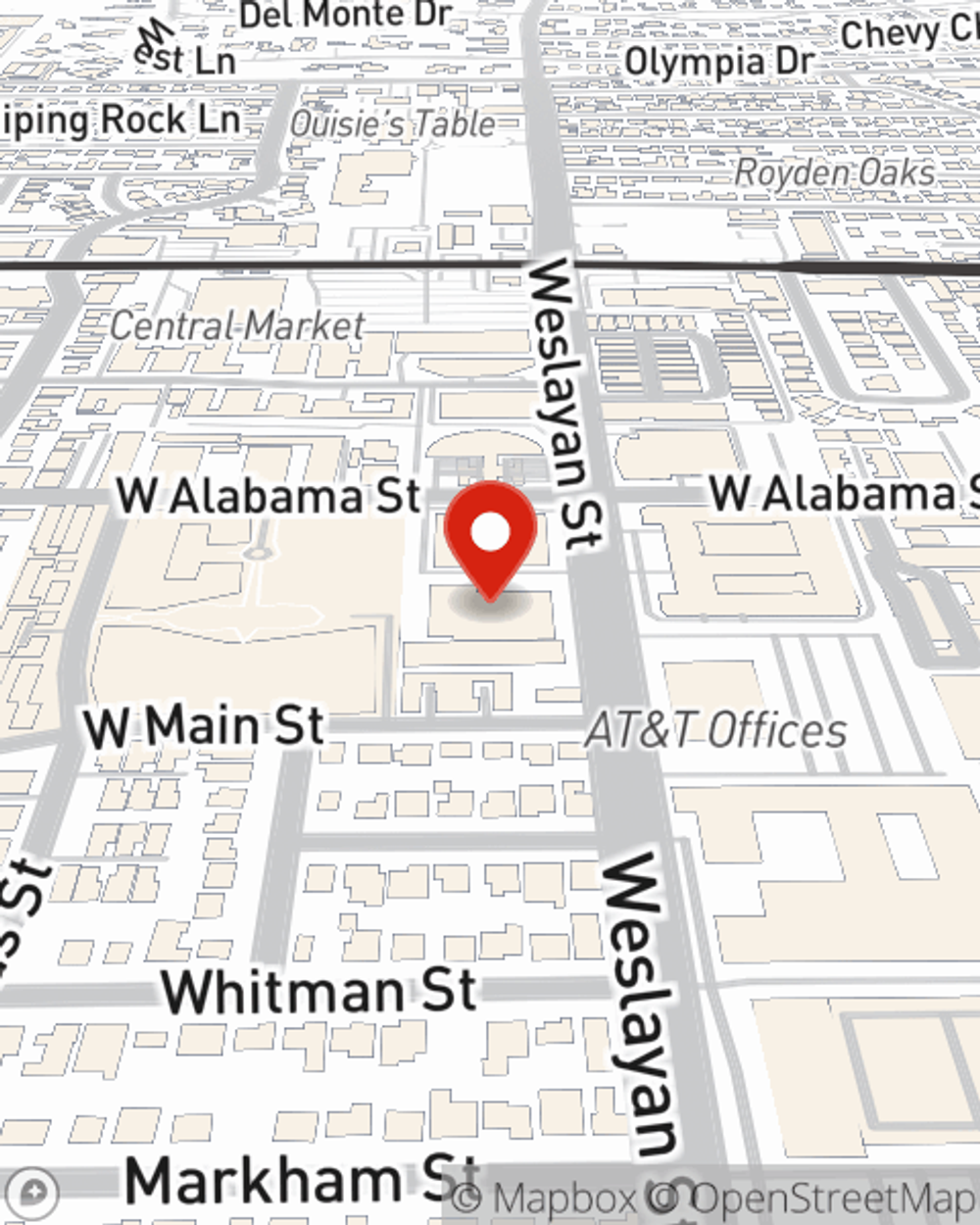

Visit State Farm Agent Felicia Olowu today to find out how the trusted name for renters insurance can protect items in your home here in Houston, TX.

Have More Questions About Renters Insurance?

Call Felicia at (281) 888-0101 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Felicia Olowu

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.